Table of Content

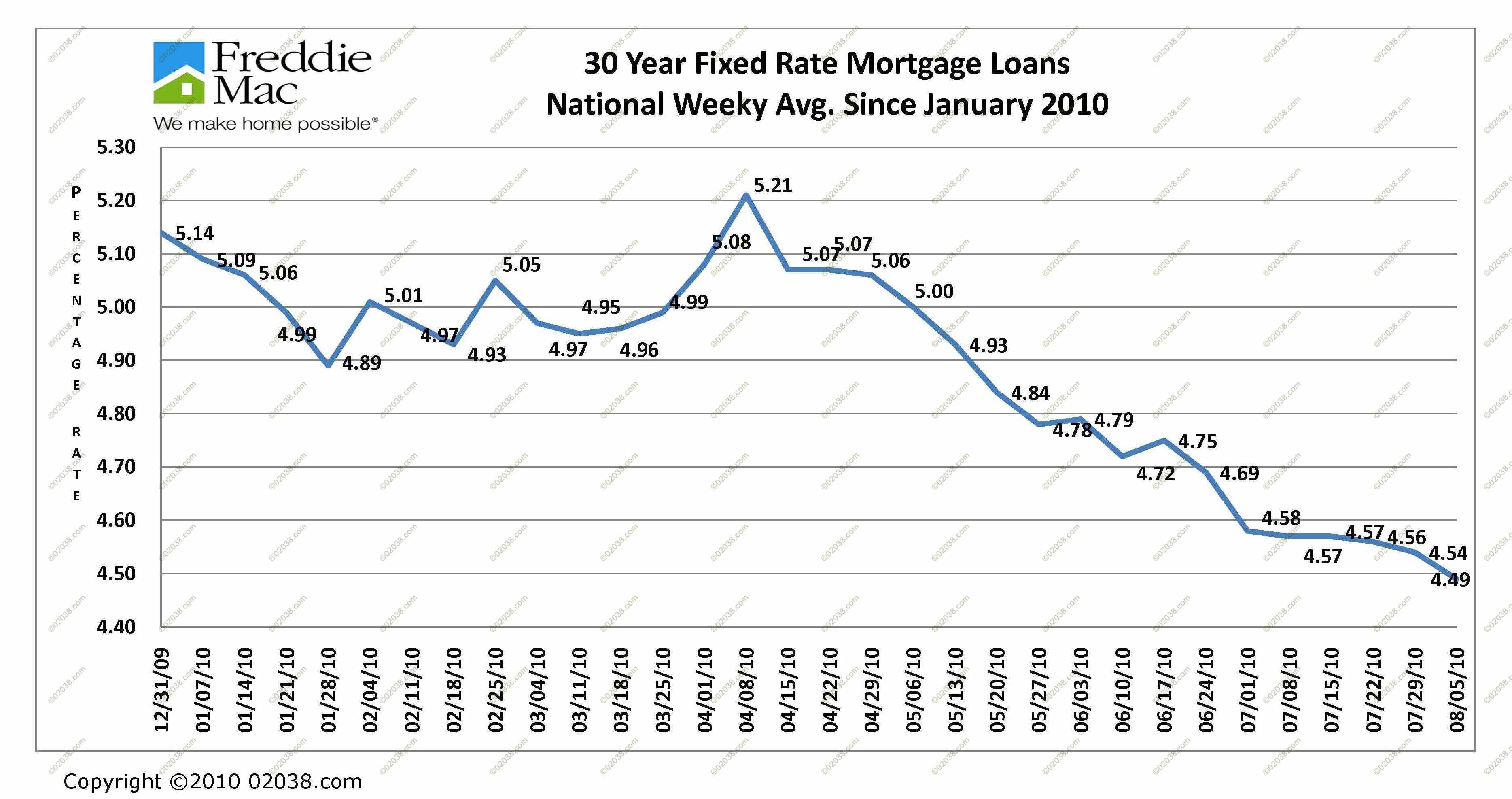

The maximum home loan tenure that you can enjoy is 30 years, if you are a salaried employee. In case of self-employed professionals and self-employed non-professionals, the maximum tenure stands at 20 years. You can visit the nearest branch and apply for a home loan or visit the bank’s official website and fill out the online application form. The amount of loan you desire also influences the interest rate and eventually EMI.

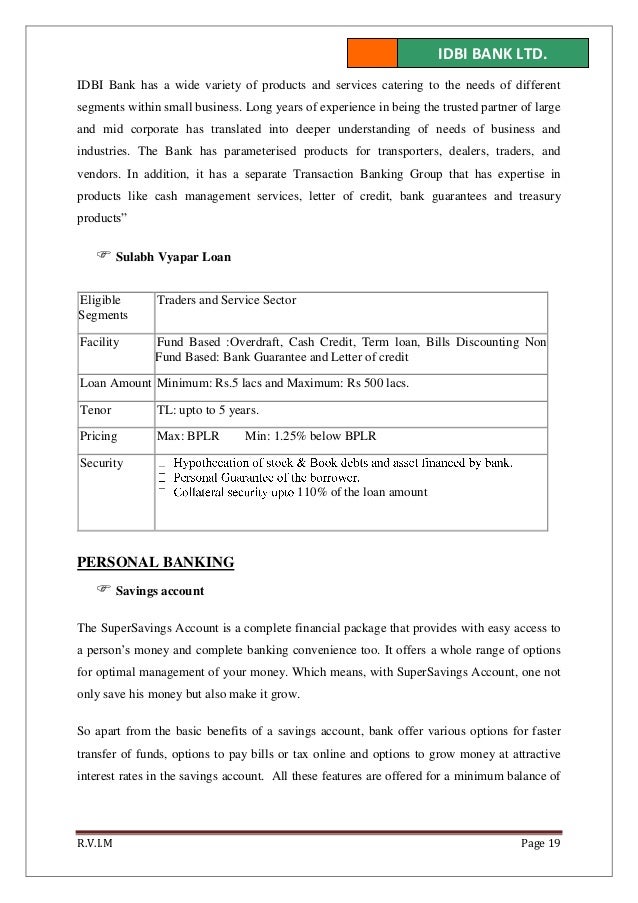

The interest rate for the IDBI Plain Villa Home Loan ranges from 7.50% to 10.65% per annum. Timesproperty is a company with rich experience in real estate advisory. You can repay your EMI for IDBI Bank Home Loan through Standing Instruction with IDBI Account or Electronic Clearing System instruction on your non-IDBI account. Salaried individuals , Self-Employed Professionals , and Self-Employed Non-Professionals are eligible to avail these loans.

IDBI Bank Home Loan Interest Rates

Expenses related to educational needs and any other similar financial requirement is also covered here. The bank charges a fixed interest rate of 10.25% on all home loans that is having a tenure which is less than 3 years. For home loans which have a tenure above 3 years, the bank charges a fixed interest rate of 10.50%. IDBI bank charges the below mentioned rates as fixed interest rates on home loans. Below are listed the features that IDBI Bank offers to its customers who have availed a housing loan from them.

At NextAdvisor we’re firm believers in transparency and editorial independence. Editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by our partners. Editorial content from NextAdvisor is separate from TIME editorial content and is created by a different team of writers and editors.

Group Company

Prepayment /foreclosure allowed after 6 months of final disbursement. In case of prepayment/ foreclosure of home loan from own source of funds, no pre-payment charges will be levied. However, a Pre-payment Fees of 2% on Principal outstanding will be levied, if pre-payments are from other then own sources. Become a financial buddy with AntworksMoney and earn sitting at home or in office just by referring your friends and relatives for loans, credit cards or other investment options. The bank offers loans to meet expenses that are related to travel, vacation, medical emergencies, etc.

When the interest rate with the loan was decreased we had to pay some fees for that as well. I have chosen IDBI home loan loan amount 23.5 lakhs, Tenure is 15 years Rate of interest is 8.75 percentage. While documents submitted executive he given clear information about loan there is no delay disbursal loan amount. The loan amount was Rs. 5,60,000 and monthly emi i am paying of Rs.4903. The EMI calculator also gives you a breakup of the total amount payable during the entire tenure along with a detailed amortization schedule illustrating your debt repayments over the loan term.

Features of IDBI Bank Home Loan

Borrowers can apply for IDBI home loans through 1780 branches & 1321 centres of IDBI Bank across all over the India. Home loan Interest rates starts from 6.90% for women, 6.95% for Others. The government-owned bank formerly known as, Industrial Development Bank of India, is headquartered in Mumbai. It is primarily a development bank that provides credit to facilitate development in India. Having 3700 ATMs, 1995 branches, and 1382 centers, IDBI is the 10th largest development bank in the world with regard to its network.

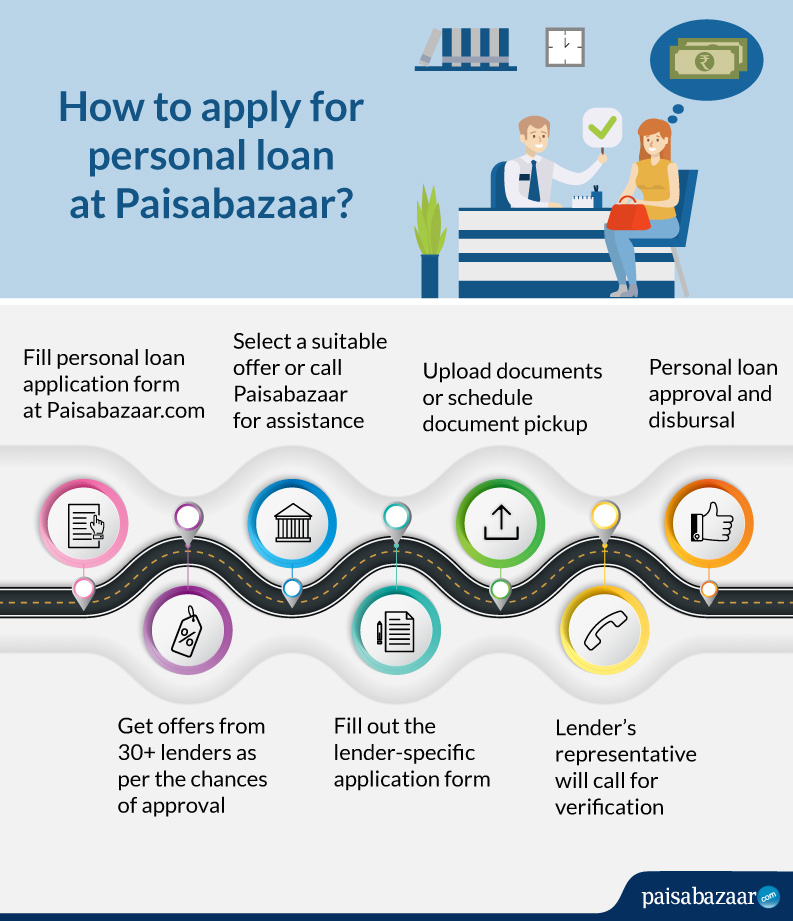

This is where the idea of a personal loan comes into the picture. There are many factors on which the interest rate on home loans depend. All these factors play a crucial role in deciding what amount one will pay as interest on your loans. In such cases the fixed rate of interest on home loan is 10.35%. The loan eligibility of an applicant is dependent on several factors. The applicant is given the luxury to apply for a loan from anywhere in India to purchase a property anywhere in India.

The bank links its floating interest rate to its Marginal Cost of Funds-linked Lending Rate . The MCLR-linked interest rate is applicable from April 01, 2016. The IDBI Bank offers a variety of facilities to the customers availing of home loans.

IDBI offers both floating interest rates as well as fixed interest rates. Also, as per RBI mandate, IDBI has switched from Base rate based lending rate to Marginal Cost of Funds based Lending Rates . Federal Bank revised fixed deposit interest for amounts below Rs 2 crore.

However, the rates have increased from before December 15. For this lending rate benchmark, SBI has hiked interest rates by 25 bps across tenure. Premium Borrowers who will have home loans from December 15 to January 31, 2023, will face interest rates starting at 8.75% compared to the normal floor rate of 8.90%. Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances.

People with lower credit scores are considered riskier borrowers and may need to compensate by accepting higher interest rates. While borrowers shunned ARMs during the pandemic days of super-low rates, this type of loan has made a comeback as mortgage rates have risen. “Many of these home equity products, unlike credit cards or anything else which is variable, allow you to lock in the price so that you have payment certainty,” Gupta says. Borrowers who will opt for SBI home loans will receive these concessions on their interest rates till January 31, 2022.

To process the home loan application, the following documents are necessary. If the bank is finished with the verification, then the bank sets the interest rate, EMI, and tenure, and will be notified to you. In case anyone finds the procedures difficult to follow, then they can visit the nearest branch to clarify their doubts. The bank also has a toll free customer care that can help you with the procedures.

No comments:

Post a Comment