Table of Content

Owning a home is one of life’s biggest aspirations, at IDBI our home loan solutions are designed to offer you convenience and make the journey to your dream home a pleasant one. Our home loan solutions cater to your home loan requirements in a customized manner and are based on the following traits. Minor's account - A minor alone cannot open an FRTD as the maturity amount cannot be determined at the time of opening the FRTD.

Thanks to its promising growth, the bank has been featured in the Fortune 2000 Top Companies in the World. The bank provides assistance in property search and due-diligence of property for acquisition. SpiceJet has proposed to settle the dues of aircraft leasing companies by turning them into potential investors from creditors, according to people aware of the discussions. The repo rate was once again increased by 0.35% by the Reserve Bank of India during its monetary policy meeting on December 7, 2022.

IDBI Bank Home Loan - Conversion from one interest rate type to another

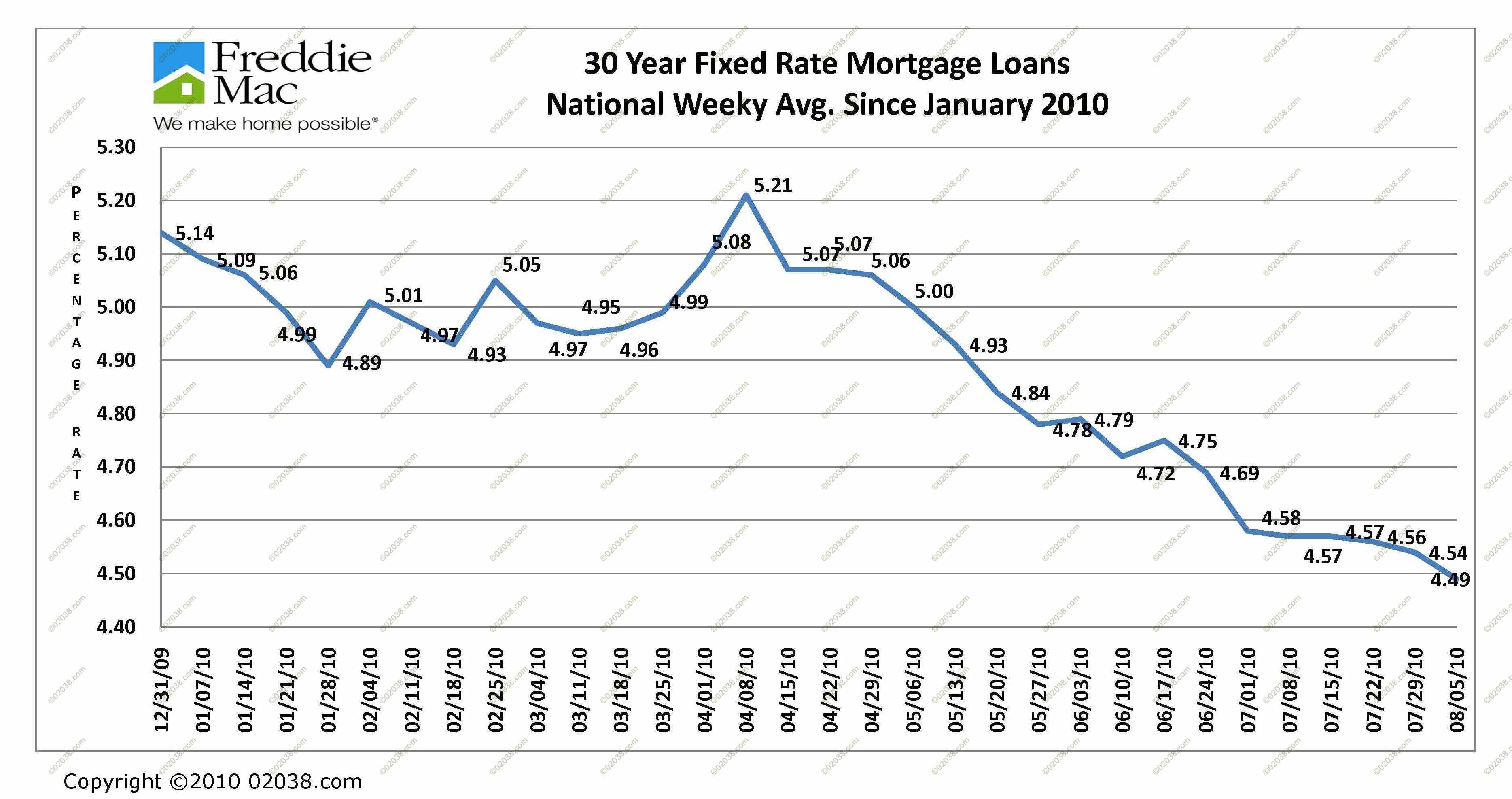

On the other hand, when the RBI decreases the repo rate, the floating rate goes down. However, negotiating for a good interest rate isn't enough; you must also select the right type of interest rate. In India, Home Loans are offered on fixed and floating rates of interest.

When this happens, they save big on their EMI payments, leading to a decent amount of net accumulated savings. If you already have a mortgage, some of the requirements for taking out a HELOC will likely be familiar. As a rough rule of thumb, homeowners usually need a maximum debt-to-income ratio of 43%; a minimum credit score of 620; a history of on-time mortgage payments; and at least 15% to 20% equity in the home. HELOCs have a set draw period, often 10 years, followed by a repayment period that can be equal or different than the draw period.

State Bank of IndiaHome Loan

Based on the analysis, we help you discover loans and credit cards best suited for your credit profile. We help you understand your Credit Profile, Credit Information Report and know where you stand. We ensure that you have a better shot at getting an approval for a loan or credit card you apply since we match the lender’s criteria to your credit profile.

One of the best ways to do this is to negotiate for a low-interest rate. There is a concession of 15 bps each on credit scores from 700 to equal to or greater than 800 on top-up loans. However, it needs to be noted that SBI continues to offer 15 bps to 30 bps concessions on its home loan rates. Under the festive offer, the bank is currently offering a concession from 15 bps to 30 bps in various home loan categories.

Document Checklist for IDBI Bank Home Loan

IDBI offers different home loan schemes, and each of them is different based on the features and interest rates. The average rate you'll pay for a 15-year fixed mortgage is 5.85 percent, down 15 basis points since the same time last week. Many HELOC lenders allow borrowers to lock their rate for a certain balance, essentially turning a variable-rate HELOC into a fixed-rate home equity loan. Consumers worried about the uncertainty of rate changes can consider that if they want to guarantee a certain payment. The average interest rates for home equity loans and lines of credit were essentially flat last week. As with any credit product, the credit check that lenders do will reduce your credit score temporarily.

The remaining amount needs to be paid by the individual as a down payment. Individuals may apply alone or in collaboration with other family members. Documents such as residential proof, income and, employment details.

Minor’s account to be can opened jointly with his/her guardian only. Interest Reset - Every 3 months, coinciding with calendar quarters - on April 1, July 1, October 1 and January 1 every year. Bank will levy a penalty of 1%, on the applicable rate for deposits closed prematurely. Such closures include the withdrawals through sweep-ins and partial withdrawals as well.

If you lock in today’s rate of 6.83% on a 30-year, fixed-rate jumbo mortgage, you will pay $645 per month in principal and interest per $100,000 in financing. That means that on a $750,000 loan, the monthly principal and interest payment would be around $4,845, and you’d pay around $992,251 in total interest over the life of the loan. The scheme is launched and regulated by the central government of India, and provides interest subsidy on education loans of up to 7.5 lacs to eligible students.

Accordingly based on the loan amount sanctioned, you may search the property. For final sanction, property identified for the purpose should meet our criteria. The total concessions in applicable interest rate not to exceed 100 bps for all customers subject to prevailing RLLR. C) The calculation of interest shall be as per extant guidelines for term deposit carrying fixed rate.

The bank had launched a festive campaign over from October 4th just ahead of the Diwali festival. Bajaj Finance hikes FD rate by up to 25 bps; senior cit ... Students must be able to produce income certificates when required. Contact WeMakeScholars by requesting a callback, stating that you wish to transfer your loan. Entrance examinations like CAT, IELTS, GRE, TOEFL etc must be cleared by students, also they must provide their report cards.

That means you’ll know what your monthly payment will be every month, making it easier to budget. That might be appealing given today’s rising rate environment. These rates come from a survey conducted by Bankrate, which like NextAdvisor is owned by Red Ventures. The averages are determined from a survey of the top 10 banks in the top 10 U.S. markets.

HELOC rates are tied more closely to banks than are first-mortgage rates, which tend to track the performance of the bond market. The Federal Reserve, which controls the interest rates that banks charge each other, has signaled to investors that it expects to raise the fed funds rate several times in 2022 and beyond. Repayment of an education loan is the most satisfying step of the entire education loan journey. The IDBI Bank education loan repayment process is simple and can be completed in a duration of maximum upto 15 years after the moratorium period. IDBI Bank changed the interest rate on fixed deposits for sums under Rs 2 crore.

Features of IDBI bank home loan

IDBI Bank offers customers a top-up facility of up to 100%. However, it is to be noted that the borrowers are required to maintain a punctual repayment track record before applying for this facility. I have applied for the housing loan with the IDBI BANK the documentation process was quick and done on time. They have given the good loan amount the rate of interest was 8.7% which was a fixed. There was a processing fee, the duration for repaying is for 15 years. Once you have submitted the form, a bank official will call you to discuss the details of your loan and the documents required.

No comments:

Post a Comment